De pagina ververst bij het selecteren van een onderwerp.

Sla artikel navigatie over.ARC Fund Risk management framework

The Fund Manager uses a Risk Management Framework to appropriately identify, measure, manage, monitor, and report on risks. The Fund manager also sets the risk indicators, risk limits, and risk appetite for the defined risks. Fraud risks are inseparable connected to risk management and are therefore integrated in the framework. The risk management performance of the ARC Fund is assessed in close consultation with the Portfolio Manager and the RCO on at least a quarterly basis and more frequently in case of significant events. The findings of the assessment are included in the quarterly Investor report's Risk Management Dashboard. The Director Finance and Risk is responsible for the risk reporting to all relevant stakeholders.

Identified risks of the ARC Fund

-

Sales / rental risk: the risk that a home or a property cannot be sold / rented out within the envisaged period at the targeted sales / rental price.

-

Operational risk: the risk resulting from inadequate or failed operational processes and/or systems.

-

Funding risk: the risk of funding shortages and mismatches between funding and commitments because the ARC Fund:

-

-

is unable to timely fund its commitments with new or existing equity and/or debt commitments at the desired conditions and/or from divestment proceeds;

-

is in breach of its contractual obligations for its debt funding, which results in defaults and mandatory repayments; or

-

incurs short-term liquidity shortages due to the insufficient coordination (by timing and amount) of cash inflows and outflows.

-

-

Portfolio risk: the risk that the portfolio development and operational results are not in line with the Portfolio Plan and as a result targeted returns are not achieved.

-

Counterparty risk: the risk that a counterparty fails to fulfil contractual or other agreed upon obligations. The main counterparties for the ARC Fund are Investors, banks, developers, appraisers, property managers, tenants, and buyers.

-

Political risk: the risk that policy changes and regulations by (local) authorities or governmental bodies affect the strategic objectives and business of the ARC Fund. The real estate sector increasingly experienced negative consequences from utility grid congestion and nitrogen emission limits, which may lead to delays in the completion and start of operation of new projects. Although the contractual risk lies with the developer, any potential negative impact for the ARC Fund increases the overall political risk.

-

Climate risk: the risk that the ARC Fund is not adequately adapting to constraints resulting from climate change and/or fails to adequately report on its actions to address climate change.

-

Governance risk: the risk that a conflict of interest is not adequately addressed by means of governance as well as checks and balances and/or the risk that the ARC Fund is inadequately equipped to operate in the event of a conflict of interest.

-

Compliance risk: the risk that the ARC Fund and its operation are in breach of legislation and regulations, which may jeopardise the Fund’s AIF status.

Risk appetite and evaluation 2024

The ARC Fund invests in income-producing real estate investments in the Dutch residential sector. The generated returns from rental income are relatively stable and the ARC Fund acquires new projects on a turnkey basis, without incurring development risk. The ARC Fund uses modest levels of leverage to enhance returns. In line with its INREV core fund risk profile, the ARC Fund has a relatively low risk profile and correspondingly low risk appetite.

During 2024, the risk indicators and risk limits for the risk categories as defined by the Fund Manager were closely monitored. Four quarterly risk meetings were held to discuss development of risk indicators together with the Director Finance & Risk, the Portfolio Manager and the RCO. The potential negative economic impact of the rent regulation and the pending legal uncertainty of the fairness of rent indexation clauses received special attention. The higher interest rate environment maintains to have a negative impact on direct fund returns as a result of increased financing costs. So far, the negative impact of expanding rent regulation on the Fund’s performance has been limited.

Sales/Rental Risk

The sales/rental risk was reduced due to the increase in investment market activity and volume as well as the high demand for individual sales.

Political risk

Anticipated (local) legislation, designed to interfere in the residential investment market, may impact the ARC Fund’s ability to execute its strategy. The Dutch government and local authorities implemented new rent regulation in 2024 which impacts the rent generating capacity of the ARC Fund going forward.

Counterparty risk

The counterparty risk was reduced despite the subdued economic climate and persistently high construction costs. The fund’s pipeline exposure to construction and development companies decreased due to successful completion of a number of projects. We continued to manage this risk effectively with no material defaults occurring.

Portfolio Risk

The portfolio risk decreased during 2024 primarily driven by the change to a positive valuation trend and the ability to execute asset disposal opportunities above book value, which supports our asset rotation strategy at commercially feasible levels.

Funding risk

In 2024, the ARC Fund made use of its committed debt facilities and sales proceeds to fund its project pipeline and redeem participations. During 2024, the debt diversification and refinancing program was successfully continued. An additional EUR 300 million of debt commitments were secured in order to meet future funding needs. The Fund successfully secured its first bond transaction with a green bond issuance. The notes were marketed to institutional investors and are listed on Euronext Dublin.

Hence, the availability of undrawn debt commitments increased. No new equity commitments were drawn as all remaining equity commitments were called in 2023. EUR 30 million of new equity commitment was sourced at the end of the year which can be used for capital calls going forward.On balance, the overall funding position increased during 2024 and funding risk decreased.

Various scenarios for liquidity – covering the expected realisation time of the acquisition pipeline and going beyond the current Portfolio Plan horizon of 2026 – were calculated and monitored. No liquidity constraints occurred in 2024 or are expected in 2025. The ARC Fund plans to secure new equity and debt funding in 2025, subject to market conditions, to fulfil outstanding redemption requests as well as fund and grow its pipeline in the coming years.

Compliance risk

Due to the fiscally transparent status of the fund, the ARC Fund is not able to incur any form of development risk as part of the acquisition of new projects for its pipeline. Therefore, the ARC Fund acquires its projects on a fixed-price, turn-key basis. In certain situations, the ARC Fund is able to secure a fixed-price, turn-key project subject to final permits and planning prior to start of construction. In these cases, the ARC Fund will obtain a put-option with a longstop date from the third-party developer, in order to be able to unwind the transaction in the event that permits or planning might not be obtained within an agreed time frame.

During 2023 and 2024 various Administrative Courts throughout the Netherlands stated that a much-applied rent indexation clause for liberalised rental housing (CPI + a max. 5% surcharge) can be considered unfair within the meaning of European Directive 93/13/EEC on unfair terms in consumer contracts (Directive) and should therefore be annulled. As part of further legal proceedings, on 29 November 2024, the Supreme Court ruled that the elements of indexation / surcharge clauses, being the 'inflation' itself and the 'surcharge' on the inflation, should be seen and judged separately. According to the Supreme Court, an indexation or surcharge clause allowing a maximum annual rent increase of 3% on top of inflation is generally considered to be not unfair and in fact provides clarity about future rent increases. This ruling is particularly important for the question whether tenants were entitled to repayment of rent paid in the past. Based on the judgment this is not necessarily the case. For now, the judgement has limited impact for the sector due to the recent extension of the Rent Increase Maximization Act until 2029 (which includes a mechanism providing a mandatory cap on indexation and surcharge).

The Supreme Court ruling follows general market sentiment, that it was a remote possibility that these judgements would be (fully) upheld.

Overall risk performance

Management has performed its risk assessments in 2024 and concluded none of the risk limits set by the Fund Manager for the defined risk categories were exceeded.

Updated risk management framework

The ARC Fund’s Risk Management Framework is a dynamic framework. The Fund Manager assesses, monitors, and reviews the risk management function, policy, framework, and its risk appetite, indicators, and limits on an annual basis and reports on these matters to the Advisory Board and Investors of the ARC Fund.

If necessary, the Fund Manager adjusts previously described risk categories in close consultation with the RCO and its stakeholders. In the fourth quarter of 2024, the Fund Manager presented the updated Risk Management Dashboard to the Advisory Board for annual evaluation.

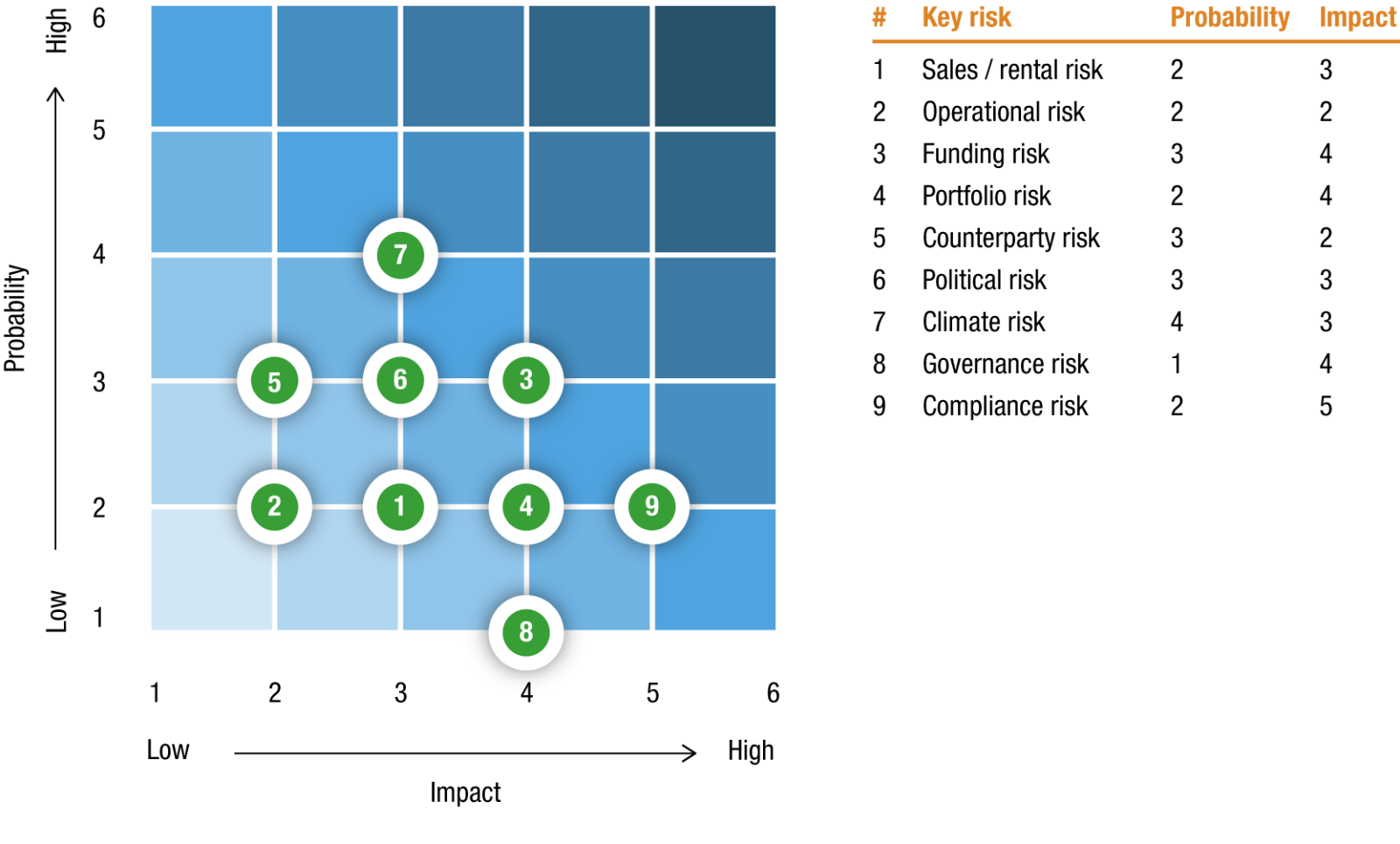

Figure 26 plots the risk categories on an impact/ probability axis.

Figure 26: Plotted risk (impact/probability)