De pagina ververst bij het selecteren van een onderwerp.

Sla artikel navigatie over.Risk management

Amvest organisation corporate risk strategy

The strategy of the Amvest organisation focuses on two key activities:

-

Dutch residential area and property development in economically attractive regions.

-

The set-up and management of Dutch investment funds and portfolios covering the residential sector.

The Amvest organisation is thus active across a large part of the real estate value chain. The link between these two key activities forms the basis of the Amvest business model: Amvest is able to create and benefit from synergy between these activities. Therefore, part of the corporate risk strategy focuses on adequately managing and mitigating the inherent ‘conflict of interest risk'.

The structure and governance of the AL&C Fund, as well as the oversight role from the depositary, and the Dutch Financial Markets Authority (AFM), help mitigate this risk.

Internal control environment

The Amvest risk management framework is designed to facilitate strong governance and risk management within the AL&C Fund. The framework is based on a control framework, which separates the function of financial and portfolio management from the function of risk management to guard against conflicts of interest.

Control framework

Fund management – Fund management is responsible for all fund-related activities, including managing the control environment and risks.

Risk & Compliance Officer (RCO) – The RCO coordinates, facilitates, reviews and advises on risk management procedures in consultation with the Director Finance and Risk to safeguard the adequate management, control and reporting of risks by the Fund Manager. The RCO acts independently from line management, and remuneration is not tied to the Fund's performance.

Advisory Board – The Advisory Board serves as an escalation line for the RCO, independently of line and risk management. The members of the Advisory Board are representatives of the investors.

Assurance on risk relating to failure of systems and processes

The Fund Manager is structured with an affiliated Fund Services Provider (Amvest Management B.V.). The Fund Services Provider employs all employees of Amvest group and provides relevant management services to the Fund Manager. An ISAE 3402 Type II framework is in place to support a consistent, high-quality level of services by the Fund Services Provider to the Fund Manager. Relevant processes carried out by the Fund Services Provider under the responsibility of the Fund Manager are described at an operational level. Control objectives and controls as part of these processes are defined.

Each year, Amvest’s external auditor audits and reports on the design and effectiveness of controls as well as General IT Controls (GITC) based on the ISAE 3402 Type II standard. Amvest selects key controls within the most important business processes to be audited, primarily related to acquisitions, property and individual unit sales and operations. Fund Management periodically assesses these controls in close consultation with the fund team, the RCO, the Fund Services Provider and the external auditor of the AL&C Fund.

For 2024 (1 January 2024 - 30 November 2024), the external auditor issued an unqualified ISAE 3402 Type II report.

AL&C Fund Risk Management Framework

The Fund Manager uses a Risk Management Framework to appropriately identify, measure, manage, monitor and report on risks. The Fund manager also sets the risk indicators, risk limits and risk appetite for the defined risks. The risk management performance of the AL&C Fund is assessed in close consultation with the Portfolio Manager and the RCO on at least a quarterly basis and more frequently in case of significant events. The findings of the assessment are included in the quarterly Investor report's Risk Management Dashboard. The Director Finance and Risk is responsible for the risk reporting to all relevant stakeholders.

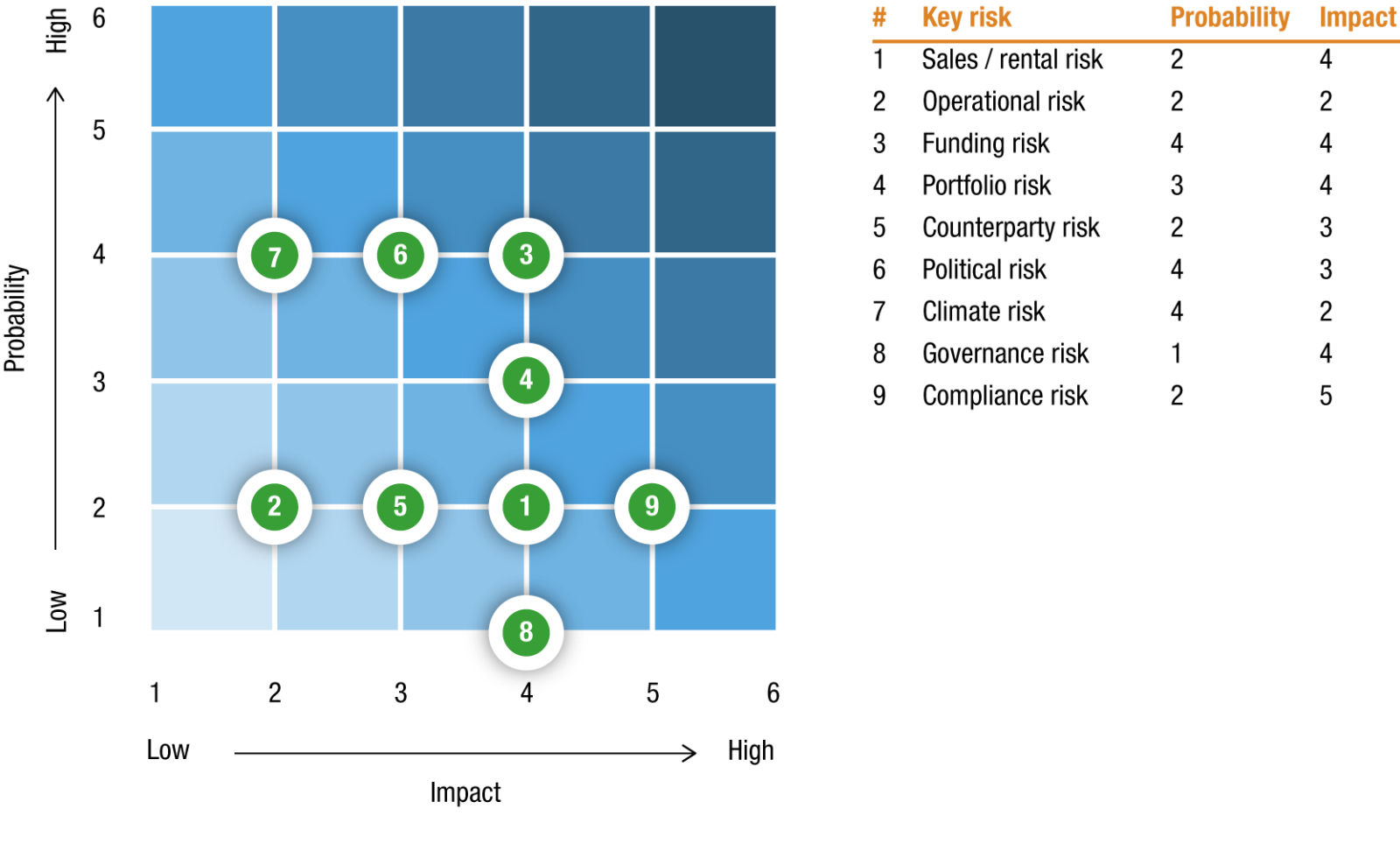

Identified risks of the AL&C Fund

-

Rental risk: the risk that a property cannot be rented out (again) within the envisaged period at the targeted rental price. This risk is particularly relevant for the AL&C Fund due to the limited number of care service providers (i.e., potential tenants) and the possibly difficult process of finding a (new) care provider for a care home.

-

Operational risk: the risk resulting from inadequate or failed operational processes and/or systems.

-

Portfolio risk: the risk that the portfolio development and operational results are not in line with the Portfolio Plan and, as a result, targeted returns are not achieved.

-

Funding risk: the risk of funding shortages and mismatches between funding and commitments because the AL&C Fund:

-

-

is unable to timely fund its commitments with new or existing equity;

-

incurs short-term liquidity shortages due to the insufficient coordination (by timing and amount) of cash inflows and outflows.

-

-

Counterparty risk: the risk that a counterparty fails to fulfil contractual obligations or other agreed upon obligations and / or harms the reputation of the AL&C Fund. The main counterparties for the AL&C Fund are tenants (care service providers), investors, property developers and appraisers. In addition, the AL&C Fund is at risk of being too dependent on one or more counterparties, particularly care service providers (concentration risk).

-

Political risk: the risk that policy changes and regulations by (local) authorities or governmental bodies affect the strategic objectives and business of the AL&C Fund.

-

Climate risk: the risk that the AL&C Fund is not adequately adapting to constraints resulting from climate change and/or fails to adequately report on its actions to address climate change.

-

Governance risk: the risk that a conflict of interest is not adequately addressed by means of governance as well as checks and balances and/or the risk that the AL&C Fund is inadequately equipped to operate in the event of a conflict of interest.

-

Compliance risk: the risk that the AL&C Fund and its operation are in breach of legislation and regulations and / or is non-compliant with the Fund’s AIF status.

Risk appetite and evaluation 2024

The AL&C Fund invests in income-producing real estate investments in the Dutch residential care sector. The generated returns from rental income are relatively stable, and the AL&C Fund acquires new projects on a turnkey basis, without incurring development risk. In line with its INREV core fund risk profile, the AL&C Fund has a relatively low risk profile and correspondingly low risk appetite.

During 2024, the risk indicators and risk limits for the risk categories, as defined by the Fund Manager, were closely monitored, and the risk framework was updated. Four quarterly risk meetings were held to discuss development of risk indicators together with the Director Finance & Risk, the Portfolio Manager and the RCO.

Portfolio Risk

The valuation of assets under construction that were acquired in 2022 in a more favourable interest rate and real estate environment received special attention. The underlying market value correction increased the Fund’s portfolio risk.

Funding Risk

Also, the lack of additional funding, which enable us to acquire new projects, was in focus of our risk assessment. The delays in raising new capital increased our funding risk and portfolio risk.

Political Risk

The AL&C Fund also increasingly experienced negative consequences from utility grid congestion, which led to delays in the completion and start of operation of new projects. Although the contractual risk lies with the developer, the potential negative impact for the AL&C Fund increased the political risk.

Rental Risk / Counterparty Risk

The financial performance and strength of our care operator partners were externally and internally reviewed in 2024. The improved performance of our partners leads to a decrease in rental risk. The counterparty risk was also reduced as the Fund’s pipeline exposure to construction and development companies decreased. We continued to manage this risk effectively with no material defaults occurring.

Overall risk performance

None of the risk limits set by the Fund Manager for the defined risk categories were exceeded.

No material changes to the liquidity management systems and procedures occurred and stress testing on liquidity showed no breaches in relation to the distribution policy as described in the Terms and Conditions and the Portfolio Plan. Various scenarios on funding, cash and liquidity were calculated and monitored. The uncalled equity commitments (€250 million) create a solid funding position for the AL&C Fund going forward. However, the lack of additional capital and the sizeable commitment for the committed pipeline may lead to a decline in growth trends and mitigating actions in the future, in case no additional new equity is raised during 2025.

Updated Risk Management Dashboard

The AL&C Fund’s Risk Management Framework is a dynamic framework. The Fund Manager assesses, monitors and reviews the risk management function, policy, framework and its risk appetite, indicators and limits on an annual basis and reports on these matters to the Advisory Board and investors of the AL&C Fund. If necessary, the Fund Manager adjusts previously described risk categories in close consultation with the RCO and its stakeholders. In the fourth quarter of 2024, the Fund Manager presented the updated risk management dashboard to the Advisory Board for annual evaluation.

Figure 8: Plotted risk (impact/probability)