Portfolio - dynamics

In 2022, the ARC Fund standing portfolio increased to 11,010 homes with a value of EUR 4.0 billion up from 10,843 homes with a value of EUR 3.9 billion in 2021. In 2022, we invested EUR 191 million in the pipeline. 6 properties for a total of 477 homes were delivered, 68 individual homes were sold and a block sale consisting of 242 homes was realised, resulting in a net addition of 167 homes.

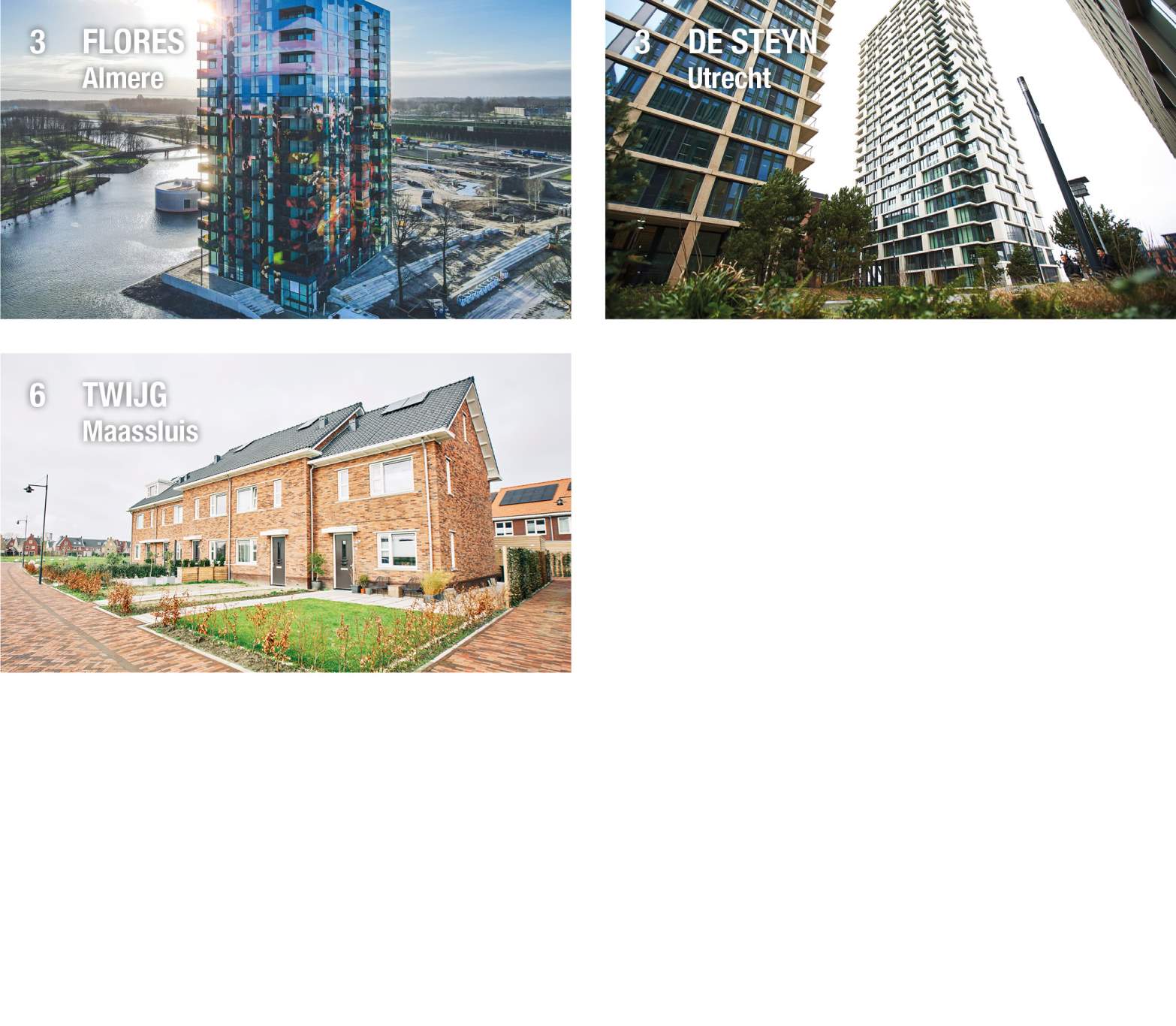

The map shows the new properties added to the investment portfolio.

Figure 21: Properties added to the investment portfolio

Investment pipeline

At year end 2022, the ARC Fund's committed pipeline included 2,533 homes for an estimated investment volume of EUR 909 million (2021: EUR 880 million).

In 2022, the investment proposal for project Sphinx in Amsterdam and KJ Plein in The Hague were approved and added to the pipeline. We acquired the Sphinx project through our RoFR agreement with ADF.

The share of properties located in the Big Four cities is increasing, as the majority of projects in the pipeline are located in Amsterdam, The Hague, Rotterdam. In addition, Eindhoven is becoming increasingly important to the ARC Fund.

Divestments

In order to revitalise the portfolio, the ARC Fund regularly divests in properties that do not longer meet investment requirements. These divestments consist of sales of individual homes to private individuals (individual sales) and the disposition of entire properties to professional investors (block sales). 68 individual homes were sold with a net gain of 21% compared to book value. One block sale in Rotterdam consisting of 242 homes and three commercial units was realised. Another contracted block sale in Groningen was terminated. The buyer could not complete the transaction which triggered the buyer's penalty clause. The total net result on sales is part of the operational result.

Figure 22: Pipeline properties